Boxes list rules for each program that's participating in Free File in an easy to read format. The online site at currently allows you to browse a variety of offers from 10 different tax providers. Once completed, the federal return is electronically filed.Once you find the tax software that you can use, you'd click on "Leave IRS site" to go to that provider's platform to begin processing your return.This can be somewhat time consuming but it is possible to do via the IRS site. So you must hunt for a tax provider that is offering services to someone in your age group or income level. One trick: Tax-prep providers participating in Free File can be specific about what returns they'd handle for free.If you have a good deal of capital gains from investments, your adjusted gross income would be higher than just your income from your job. It can be lower than your gross income after factoring in pre-tax contributions to a 401(k) or health savings accounts.

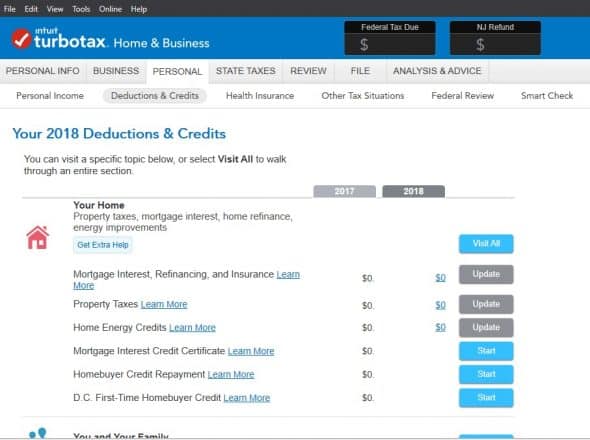

Turbotax file 2019 how to#

But you need to pay attention to how it works and how to avoid other products with fees.įree File brings together different software programs offered by rival, private tax-prep companies.

Turbotax file 2019 for free#

Using this program you can prepare and file your federal individual income tax return for free using tax software. The Free File program remains a solid option, something that could save hundreds of dollars in tax prep services for young workers and those on limited budgets. Such deceptive practices had been raised by ProPublica in late October. In fact, critics charge that some tax software firms even went out of their way so that you couldn't find their Free File offerings "by using a coding device to hide Free File services from internet search results or buying ads that directed taxpayers towards their fee-based software products," according to the 2019 Taxpayer Advocate Service Annual Report to Congress released in early January. If you never heard of Free File or have no idea how to use it, you're far from alone.

0 kommentar(er)

0 kommentar(er)